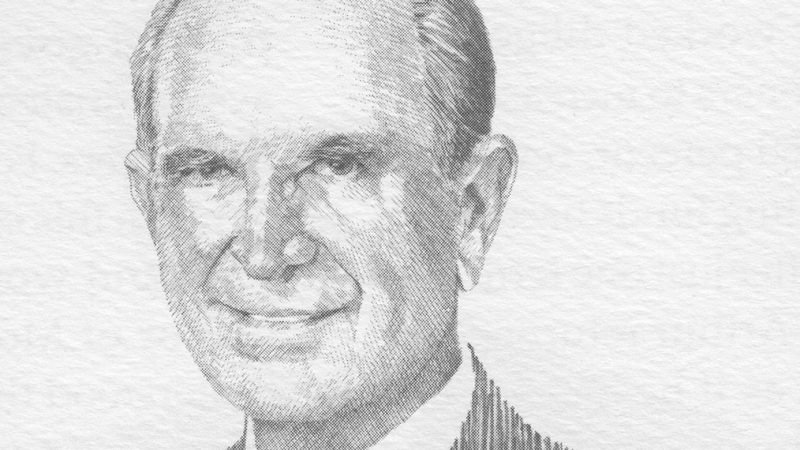

James Coleman Lee, Jr.

- October 18th, 2021

Family pride, cutting-edge packaging innovations, and a fierce competitive streak have been the driving forces behind Jimmy Lee’s unparalleled success in his industry, a success made all the sweeter because this lifetime soft drink man made his mark ” with Pepsi – almost literally in Atlanta-based Coca-Cola’s back yard.

Born January 10, 1920, to parents Elizabeth Turley and James Coleman Lee, Sr., in Birmingham, Alabama, James Coleman “Jimmy” Lee, Jr. was also born to the world of sugars and fizz; his father was second-generation president and owner of the Buffalo Rock Company. As Jimmy grew up in this family with ginger ale bottling roots, he greatly anticipated the day he, too, could become a part of the business his grandfather Sidney Lee founded during the Civil War. “The Lee family is tied to the beverage industry totally,” said Jimmy, who as a small child had a drink stand in his neighborhood and would go with his father to the family plant and see the truck drivers off on their delivery routes each day. Later, at age 19 he would load those same route trucks during the summer. “I enjoy it, my entire family enjoys it,” he said. “I guess we were weaned on a soft-drink bottle.”

However, Jimmy’s dreams of joining the family business would have to wait; first came the pursuit of higher education at Birmingham Southern College and Auburn University. Then World War II erupted and his country needed him; Jimmy left college during his junior year and within three years of joining the U.S. Air Force in 1943 had climbed the ranks from private to first lieutenant while in troop carrier command in England. After military service, the young man came back to Alabama eager to become a contributor at Buffalo Rock. Sadly, it was not too long after Jimmy joined the company that it became apparent his presence was much needed; James Lee, Sr., had fallen ill, and many, of his goals were still unfulfilled.

When the senior Lee passed away in May of 1951, his son – shaken by the loss of the role model he loved so dearly – took the reins as president of Buffalo Rock. Only one month later, with company sales at approximately $1 million and with fewer than 100 employees, 31-year-old Jimmy set out to realize one of his late father’s goals: signing with the Pepsi Cola Company. Jimmy successfully bought into the Pepsi franchise, and thus he embarked on the journey that would lead Buffalo Rock to become one of the industry giant Coca-Cola’s fiercest competitors in the South as Jimmy skillfully guided his company into handling other national brand products, along with smaller regional brands.

Another move Jimmy made early in his tenure as president was to buy out the holdings other family members had in the company. “I wanted the flexibility to do well or not to do well,” he recalled years later. “If I took a chance and went broke, I didn’t want my family to suffer.”

That flexibility paid off: Jimmy bought into the Dr. Pepper franchise in 1957 and followed that move with the purchase of the 7UP franchise in 1962. Buffalo Rock received well-deserved accolades as it became the largest family-owned Pepsi-Cola operation in the country – a status it still retains today. In 1966, Jimmy moved to ensure the growth and success of his grandfather’s company by building the then-most up-to-date bottling plant in the United States on a 27-acre site on Oxmoor Road in Birmingham. Further raising the bar on its competition, Buffalo Rock also added two additional production lines to the newly opened facility and handled more flavors than most bottlers, including Pepsi Cola, Dr. Pepper, Mountain Dew, Yoo-Hoo, Hershey’s, Grapico, 7UP, Sunkist, Ocean Spray, and of course Buffalo Rock. The company now has seven production lines and has added Tropicana to its family of products.

It was also in the 1960s that Jimmy made his mark on the soft drink industry with the first of his bold packaging innovations. In 1967 Buffalo Rock became the first company to market a 10-ounce non-returnable bottle – an innovation made even more remarkable because of its easy-open spin-top close feature. After that the number of employees at Buffalo Rock continued to climb steadily, totaling more than 1,000 over the next two decades thanks to acquisitions ranging from Dothan, Alabama, to Pensacola, Florida, and Columbus, Georgia. The 1980s were truly a time of success as Jimmy made another bold packaging move and introduced a product that would revolutionize the beverage industry: in 1984, consumers in the Birmingham market became the first to buy their soft drinks in three-liter bottles.

Strategic product innovations continued with a “best used by” date stamped on all cans in 1993 and the invention of Pourfection two-liter bottles in 1996. Buffalo Rock’s competition scrambled frantically as consumers embraced the easy-to-pour design, which Jimmy said he believed allowed for easier pouring for consumers of all ages. Once again, Jimmy left the competition to jump on his bandwagon as Buffalo Rock’s sales increased to $380 million.

In addition to setting industry trends, Jimmy, married since 1986 to the former Rose Marie Rezzonico and father to James C. Lee III, Peyton Leigh, and Donaldson Lee, focused on maintaining employee relations. “We have an open-door policy,” Jimmy said. “Employees can walk into my office, and we treat our employees as individuals, not numbers.” In 1976 he further backed up that philosophy by beginning a 401(k)/profit-sharing plan approximating $40 million. Strong employee relationships are even more important to Jimmy today as the company, with a payroll of $70 million, employs more than 2,400 employees and serves 5 million people with 14 distribution centers in Alabama, Florida, and Georgia.

Although he did not complete his own college degree, Jimmy’s firm belief in the value of higher education and in giving back to the community led him over the years to serve as president of the Board of Trustees of Birmingham Southern College and head for four years of the President’s Council of the University of Alabama at Birmingham. He is currently a member of the Board of Trustees of Leadership Birmingham and the Southern Research Institute, and a member of the University of Alabama President’s Cabinet, and is also a director of the Economic Development Partnership of Alabama.

Through the years Jimmy’s hard work and success as a business leader and his dedication to his community have been recognized through numerous awards, including the first Birmingham Service Award in 1983 and his induction into the prestigious Alabama Academy of Honor in 1987. In 1972 he was the recipient of the Distinguished Service Award by the Alabama Soft Drink Association, and in 1978 received the Beverage Man of the Year Award. One of his crowning industry glories came in 1987 when he was inducted into the Beverage Industry Hall of Fame.

But there is another industry glory even more important to Jimmy Lee, now chairman of a Buffalo Rock that ended 1997 with $400 million in sales. Thanks to him, his children, and their children uphold a family tradition by going to work each day for a company that began making its mark on the soft drink industry in the 1800s – and will continue to do so long into the next century.