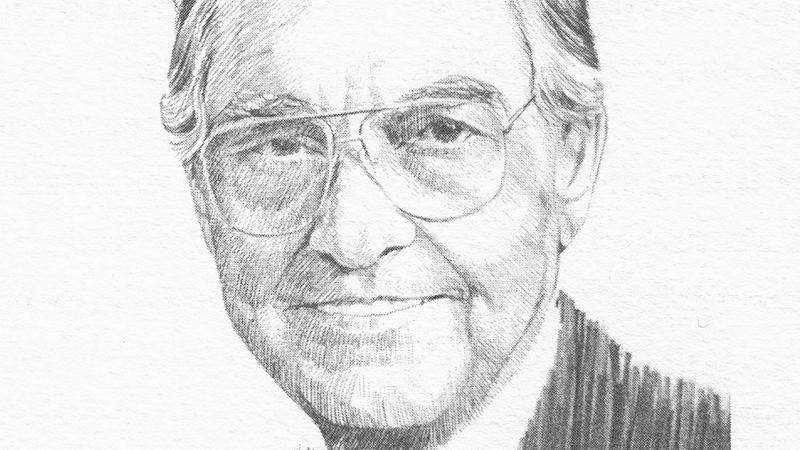

Benny M. LaRussa Jr.

- December 5th, 2025

Benny LaRussa Jr.’s entrepreneurial instincts were shaped early in life by his family’s legacy. His grandfather, Joe Bruno, founded Bruno’s grocery store and Big B Drugs, building each into two of the South’s most recognized supermarket and drugstore chains. His father, Benny LaRussa Sr., carried on that tradition of growth by purchasing Jack’s Family Restaurants initially as a franchisee and eventually acquiring the balance of the company owned stores. Over a 30-year period Jack’s family restaurants grew from 13 stores to nearly 150 units. Growing up in this environment gave LaRussa a first-hand view of the hard work, vision, and courage required to run and expand successful businesses.

LaRussa Jr. is the founder and CEO of Sterling Capital Management, a multi-asset holding company headquartered in Birmingham, Alabama. Under his leadership, Sterling Capital has built a diverse portfolio of businesses that reflect both his strategic vision and his commitment to strengthening communities.

Today, the firm owns and operates three primary platform companies: Fenwick Food Group, which invests in and operates consumer-packaged goods businesses such as Wickles Pickles and Moore’s Marinade and Wing Sauces; American Pipe and Supply, a regional wholesale distributor of pipe, valves, and fittings; and StoneRiver Company, which specializes in the acquisition, development, and management of multi-family residential properties. Through these ventures, LaRussa has helped create companies that not only generate jobs but also provide long-term value to the regional economy.

He earned a bachelor’s degree in finance from Auburn University before pursuing a master’s degree in public and private management from Birmingham-Southern College.

LaRussa began his career in banking at the First National Bank of Birmingham, now Regions Bank. In 1985 he was a founding member of First Commercial Bank, where he spent six years gaining valuable experience in financial services and client management. This period provided him with the skills and industry insight that would prove essential when, in 1991, he co-founded Canterbury Trust Company, Inc., a privately owned state-chartered trust company. Canterbury Trust quickly established a reputation for quality and reliability with over $1 billion in assets before eventually being sold to Synovus Financial Corporation.

At Sterling Capital, LaRussa provides strategic leadership, cultivates staff development, and draws on more than 35 years of operations and investment acumen in real estate and operating companies. The success of StoneRiver, American Pipe & Supply, and Fenwick Food Group are a direct reflection of his ability to combine sound investment practice, strategic execution, and operational excellence with a long-term, community-minded approach.

LaRussa has devoted much of his time and energy to civic and philanthropic service. He currently serves on the board of directors for Security Engineers Inc., Quarterbacking Children’s Health Foundation, Ascension Healthcare, and the Joseph S. Bruno Charitable Foundation. He has also supported organizations such as the Juvenile Diabetes Research Foundation, UAB Comprehensive Diabetes Center, Children’s Hospital of Alabama, and The Bell Center. His commitment to community is reflected in the countless number of nonprofit boards he has served.

LaRussa has served on boards for St. Vincent’s Health System, Bruno’s, Inc., Jack’s Family Restaurants, Synovus Bank of Birmingham, and Auburn University Foundation where he chaired the board from 2019 to 2020 and also served on the Auburn University Real Estate Foundation. His long record of service to Auburn includes many years on the Dean’s Advisory Committee for the Raymond J. Harbert College of Business. In 2022, the Alabama Chapter of the Association of Fundraising Professionals honored him as a VIP (Volunteer in Philanthropy) for his support of UAB’s Comprehensive Diabetes Center.

He and his wife, Lynn, live in Birmingham. They have two daughters and four grandchildren.