Billy Rushton has been a part of Protective Life Insurance Company for nearly 62 years, since 1937. That’s when his father, Colonel William J. Rushton, was elected president of the company.

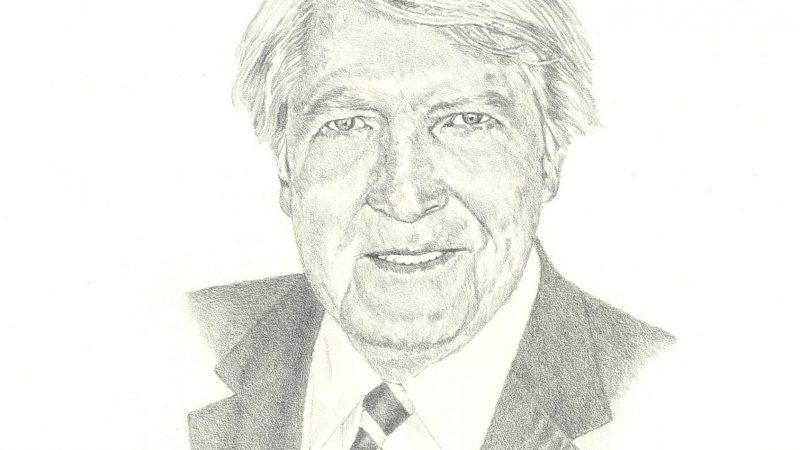

William J. (Billy) Rushton, III, was born April 23, 1929, in Birmingham, Alabama, the son of Colonel William J. Rushton and Elizabeth Perry Rushton.

“I inherited from them a good name, a desire to do my best, a sense of obligation to serve my community, and above-average opportunity to render that service,” Rushton says.

Rushton, who retired as Chief Executive Officer in 1992 and as Chairman of the Board in 1999, has made exemplary use of his “inheritance.”

In his 45 years as an employee of Protective Life Insurance Company, Rushton’s integrity, and uncompromising insistence on quality in all with which he is associated have set standards by which an entire company and its people measure themselves.

“Protective Life has his mark,” says Drayton Nabers, Jr., current Chairman and Chief Executive Officer of Protective Life Insurance. “In his generation of leadership, Billy gave the company its mission and values … its quality. Quality is written all over the company, its assets, its balance sheet, its service … and especially its people. This quality is a living thing, and he is its heart and soul.”

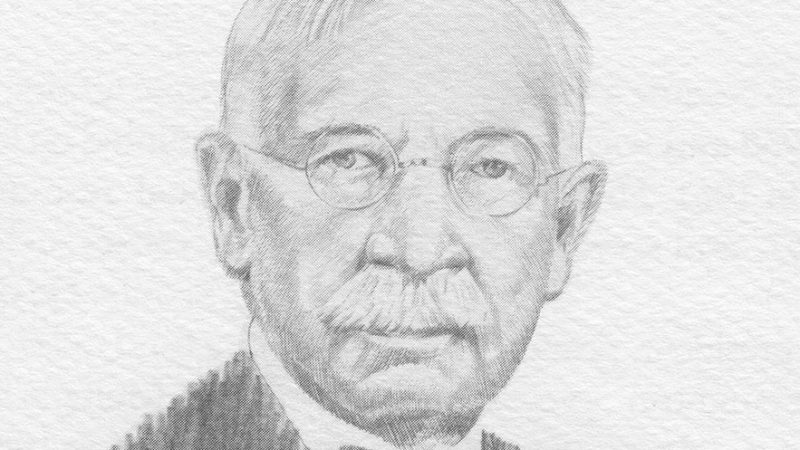

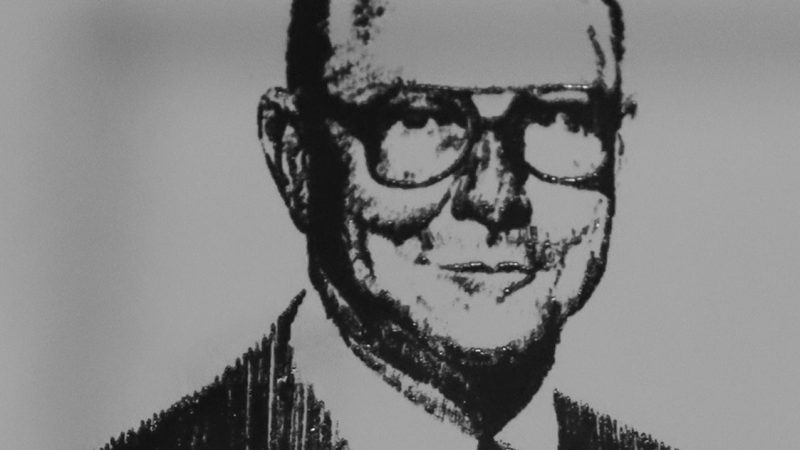

Rushton acknowledges that he was born a fortunate person, with the proverbial “silver spoon” close at hand. And he is the third Rushton to be inducted into the Alabama Business Hall of Fame. His father, William J. Rushton, and his grandfather, J. Frank Rushton, have been previously honored, in 1980 and 1975 respectively. But make no mistake, Billy Rushton has paid his dues and earned his keep.

As a youth, he attended Birmingham University School, which became Altamont School, before heading off to Exeter and eventually Princeton. He is an Eagle Scout, Scouting’s highest honor. At University School he received the Citizenship Trophy for best all-around student and was awarded the Scholarship Cup for having the highest scholastic average in the school. At Phillips-Exeter Academy, where he graduated in 1947, he was a member of the varsity swimming team and varsity crew.

The next stop was Princeton University, where he earned a Bachelor of Arts degree in mathematics, graduating Magna Cum Laude in 1951.

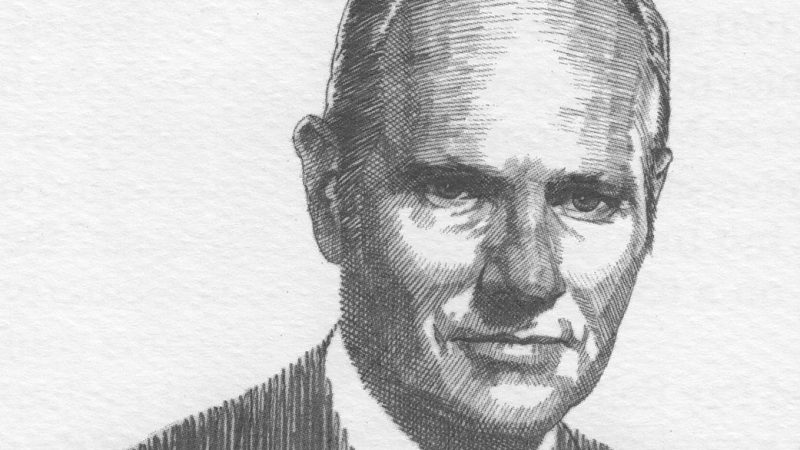

But before he could begin his insurance career, there was a matter in Korea where Rushton served as an Artillery Forward Observer and later as a Battery Commander, rising to the rank of Captain. His service in Korea earned him the Bronze Star for meritorious service in combat.

Upon returning home from the battlefield, Rushton joined Prudential Insurance Company as an actuarial trainee, then joined the actuarial department at Protective Life. Four years later he resigned as an officer and became an insurance salesman. And in his third year, he led Protective Life’s sales force in sales and qualified for the Million Dollar Round table.

By 1963 he had worked his way up to Vice President and Director of Individual Sales, a post he held until 1968. In 1969 he was elected President and Chief Executive Officer, a role he accepted as nothing less than a personal responsibility for the future of the company.

His vision for Protective Life was to see it grow to national prominence. He assembled a highly motivated management team and set “stretch” goals. His leadership style is that of a servant, although a determined one.

Since 1969 when Protective Life was licensed in only 14 Southeastern states with revenues of $57 million, the company grew steadily through sales and acquisitions to the point that by 1992, when Rushton stepped down as chief executive officer, it was represented in all 50 states with revenues exceeding $500 million and assets of more than $3 billion.

During his 22 years at the helm, Protective Life shareholders benefited greatly. Net income per share grew at a compound rate of 13.7 percent per year and the dividend per share at a rate of 12 percent per year, ranking the company in the top 20 percent of the life insurance industry.

Rushton has always been known for having an open office. He has instilled, through example, a sense of fairness throughout the company, insisting that profit never be pursued at the cost of honor or truth or at the expense of others.

He has willingly assumed the responsibility of good citizenship and contributed his time, energy, and resources to charitable and civic endeavors. He has served as a trustee at Birmingham-Southern College and as chairman of the board of trustees; director of the Birmingham Area Chamber of Commerce; a trustee at Children’s Hospital; as chairman of the Family and Child Services Capital Campaign in 1990; a member of the Advisory Committee, Meyer Foundation; as a board member and chairman of the Community Foundation of Greater Birmingham; President of the Rotary Club of Birmingham; a director at Southern Research; chairman of the Business Partnership for Alabama School Reform; and trustee of The Newcomen Society of the United States and chairman of the Alabama Chapter.

His United Way activities are legendary. He is a member of the National Mega Gifts Committee of United Way and has been a director at United Way since 1974, serving as Chairman of the United Way campaign in 1978 and as President of United Way in 1986. In 1978, the United Way Board of Directors had decided the goal for the campaign would be a 5 percent increase over the previous year. But to better meet the community needs, the Board of Directors, at Rushton’s urging, raised the target to an 11 percent increase. The campaign went on to exceed the 11 percent target and produce the largest percentage of increase in giving in Birmingham’s United Way history.

His list of honors is equally long. He is a member of the Alabama Academy of Honor, and he is a Distinguished Eagle Scout, an honor reserved for Eagle Scouts who distinguish themselves in later life. He has received the “Good Neighbor Award” from the National Conference of Christians and Jews as well as the organization’s Brotherhood Award and is an Honorary Life Member of United Way.

Rushton’s wife, La Vona, of Oklahoma City, has been an able and willing companion since 1955. They have three sons, William J. Rushton IV, Deakins Ford Rushton, and Tunstall Perry Rushton, three daughters-in-law, and seven grandchildren.

Mrs. Rushton, an accomplished pianist, and “fabulous” grandmother has served as chair of the Symphony Ball, the Museum Ball, and the Birmingham Festival of Arts. The couple spends a month in Paris each year, and Billy says, “I work very hard at golf, and though I am not very good at it I am still optimistic.”

Rushton uses an old Irish proverb to describe his feelings about his own charitable giving:

“I have drunk from wells I never dug and been warmed by fires I never built.”

True perhaps, but Billy Rushton has provided spiritual drink for many and fueled the fires of giving throughout his distinguished lifetime.