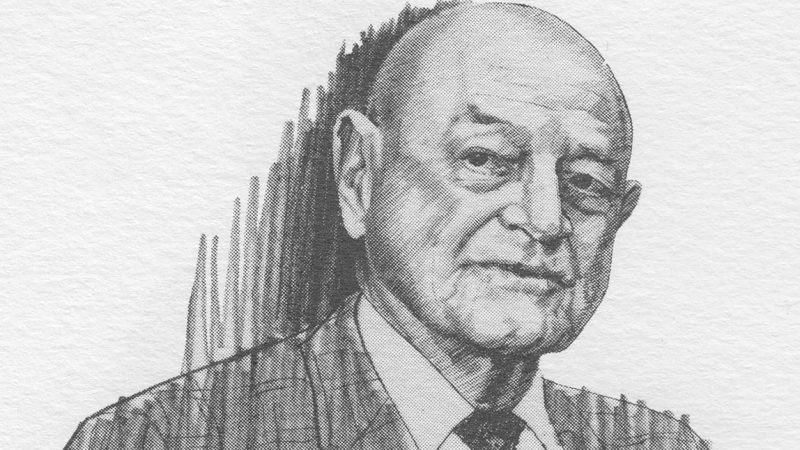

John Anthon Hand is one of the first two living inductees into the Alabama Business Hall of Fame.

His name is synonymous with the First National Bank of Birmingham, an institution he has faithfully served for four decades. Hand was born in Rome, Georgia, on November 18, 1901. The son of Thomas Oscar Hand and Bertha Maddox Hand, he was one of six children. His father was state manager for the State Mutual Life Insurance Company headquartered in Rome.

Hand attended public elementary and high schools in his native city. During the summers, when he was older, he began work in a bank in Macon, Georgia, filing checks. Upon graduation from high school, he was hired by the Fourth National Bank of Macon for a clerical position. The head teller at Fourth National was a close friend and when a position came open at the Farmer and Merchants Bank in Sylvester, Georgia, he urged young Hand to apply for it. Thus, Hand became the new assistant cashier at the Farmers and Merchants Bank.

After a year in this position, Hand was appointed Assistant National Bank Examiner by the Comptroller of the Currency and assigned to the Sixth Federal Reserve District. He was soon promoted to Senior Assistant National Bank Examiner.

Ellis D. Robb, his immediate supervisor, and Chief National Bank Examiner wrote:

Perhaps in the five years, I have been Chief National Bank Examiner in Atlanta of the Sixth District, there has been no more faithful, efficient assistant than has been John A. Hand.

It is my belief that Mr. Hand will make good at any bank work he may attempt in any bank anywhere.

John Hand was only twenty-six years old and was soon to embark on his long career in Birmingham.

In 1928 the Traders National Bank of Birmingham merged with the American Trust and Savings Bank to form the American-Traders National Bank with John C. Persons as President.

The Sixth Federal Reserve District sent examiners to conduct a routine audit and while the investigation was being held, Persons asked the chief examiner to recommend an auditor for the new bank. The examiner suggested John Hand. Hand accepted the position and moved to Birmingham. Before he could begin work as an auditor he received additional responsibilities. American-Traders National Bank was in the process of acquiring a number of private neighborhood banks in Birmingham and Hand was assigned to oversee the operations of these institutions. Some years later these banks became the first suburban branches of First National.

Following the Stock Market Crash of October 1929, financial institutions across the nation suffered from the ever-deepening depression. In order to protect their customers and assets, Persons suggested a merger of his bank with First National Bank of Birmingham, the city’s largest financial institution. Upon the merger on July 1, 1930, John Hand became

Comptroller at First National. Shortly afterward, he was loaned to the Reconstruction Finance Corporation to examine Alabama banks applying for federal loans.

Meanwhile, other activities consumed Hand’s time. In 1931 he attended Harvard Business School and later the School of Banking at Rutgers University where he graduated in 1936.

The following year he was promoted to Vice President at First National.

In the early 1930s, Hand began the important job of raising a family. Shortly after his arrival in Birmingham, he met Eula Elizabeth Gibson, and on November 1, 1930, they were married. They later became the parents of a daughter, Barbara, and a son, John.

Hand has always been a strong believer in community involvement and has encouraged First National personnel to become involved in civic and charitable activities. He himself has set the example. During the 1940s he was an active member of the Jefferson Hospital Board. He has served as general chairman of the Community Chest fundraising campaign and for two years as President of the Jefferson County Community Chest. He also has been a president of the Birmingham Rotary Club and the Festival of Arts and Vice Chairman of the Salvation Army. Immediately after World War II, he served as treasurer for the “Crusade for Children” drive. As Director and member of the Executive Committee of the Birmingham Chamber of Commerce, Hand has sought to attract new industry and thereby diversify the economy.

Because of his strong commitment to his community, John Hand has received many awards and honors. Among those is induction into Alabama’s Academy of Honor. Educational institutions also have recognized his contributions. In 1961 he was recognized by The University of Alabama for his support of engineering education. Ten years later the University of Alabama in Birmingham awarded him an honorary Doctor of Laws Degree. He was praised as “a banker deeply committed to improving the economic welfare of the community and the well-being of its citizens.” In 1972 he was named to the Board of Visitors of The University’s College of Commerce and Business Administration. Samford University also awarded him a Doctor of Laws Degree.

While continuing his active civic and community work, he was steadily progressing at First National. In 1953 he became Executive Vice President and a Director. In 1956 he was named President and on May 1, 1958, he became Chief Executive Officer.

During Hand’s tenure as Chief Executive Officer, First National Bank underwent an unprecedented expansion, aided by the sound banking philosophy he espoused: First, last and always I think a bank should be conservatively operated. We’ve operated this bank that way for years and years. For a bank to survive, however, it must also be aggressive and its officers must stay in contact with customers. They must make calls. If they do not, customers will be lost.

Under Hand’s guidance, the deposits grew from $326 million in 1958 to more than $780 million in 1972. In 1958 the bank had 13 branches; fourteen years later it had 29. Hand’s leadership has resulted in other significant contributions. One of the most lasting was the completion in 1971 of a new bank building located at Fifth Avenue and Twentieth Street in Birmingham. This impressive structure was a joint venture between Southern National Gas Company and First National Bank. Another significant development was the formation of the Alabama Bancorporation. The planning for this bank holding company was done in the late 1960s under Hand’s guidance. When appropriate federal legislation was passed and applications were approved by the Federal Reserve Board, the First National Bank of Birmingham joined Alabama Bancorporation in February 1972.

Because of his sound leadership, Hand was named Chairman of the Board on January 1, 1968, and on August 1, 1969, he was named Chairman of the Executive Committee. Throughout this period he retained the position of Chief Executive Officer.

Hand’s business abilities resulted in other corporations seeking him as a director. In his long career, he has served as director of some of the following companies: Protective Life Insurance, Alabama Power, Moore-Handley Hardware, Alabama Gas, Engel Mortgage, and Steward Machine. He was also a director of the Birmingham Branch of the Federal Reserve Bank of Atlanta.

After forty-four years of banking service, John Hand retired on December 31, 1972, from the day-to-day operations of First National. He still retains several corporate directorships and remained a director with First National until February 1974. Despite the fact that he is retired, Hand visits the bank daily.

Hand’s s contribution to the banking industry, and First National, in particular, is concisely stated in his introduction to a Newcomen Society meeting: “The First National Bank’s success has been due to his personal resourcefulness, his acumen, his sound judgment, direction, and leadership.”